Now Reading: UK Shoppers Embrace Healthy Habits as Grocery Price Inflation Eases

-

01

UK Shoppers Embrace Healthy Habits as Grocery Price Inflation Eases

UK Shoppers Embrace Healthy Habits as Grocery Price Inflation Eases

UK consumers kicked off 2026 by prioritizing healthier foods such as fresh fruit, dried pulses, and yoghurt as grocery price inflation eased to its lowest level in nine months, offering households some relief amid ongoing cost pressures. According to recent market data, inflation on food prices dropped to around 4 percent in January — down from 4.3 percent in December — with spending patterns shifting toward value and nutrition as shoppers manage tighter budgets and health goals.

Inflation eases, and spending patterns shift toward nutritious choices

Data from Worldpanel by Numerator shows a noticeable shift in UK grocery shopping habits in January 2026. Grocery price inflation eased back to about 4 percent, the lowest since April 2025, reflecting slower price growth after months of elevated inflationary pressure. Retail experts say this moderation has helped households seeking both value and quality in their weekly shops.

Also Read: Airtel Africa Dominates Fibre Expansion to Solve Stifling Data Demand

Nearly a quarter of shoppers actively sought higher-protein products, while a similar share focused on high-fibre options — a trend consistent with consumers balancing post-holiday budgets with longer-term health resolutions. Sales volumes of fresh fruit and dried pulses both rose roughly 6 percent year-on-year, while chilled yoghurt sales increased by around 4 percent over the same period. Other nutritious categories, including fresh fish and poultry, also saw modest gains.

Cottage cheese stands out as one of the standout performers, with purchases up a striking 50 percent compared with the same month last year. Analysts suggest that part of this growth reflects a broader interest in high-protein and functional dairy products, which consumers associate with wellness benefits. Functional drinks — marketed for attributes such as energy or gut health — also reported increased purchase rates, even though they typically sell at higher prices than mainstream soft drinks.

Value-oriented strategies help households stretch budgets

Alongside nutritional choices, UK shoppers also demonstrated value-focused behavior in response to inflation trends. Supermarket own-label products accounted for around 52.2 percent of total grocery spending in January, the highest share on record, as consumers gravitated toward lower-cost alternatives. Promotional sales also gained traction, with spending on discounted items rising sharply year-on-year, while full-price sales grew at a more modest pace.

The combination of eased price growth and strategic buying helped take-home grocery sales rise by about 3.8 percent over the period, although volume growth was constrained by inflation’s lingering effects. Market analysts note that value brands and price promotions have become more important tools for retailers aiming to maintain consumer engagement as households remain cautious with spending.

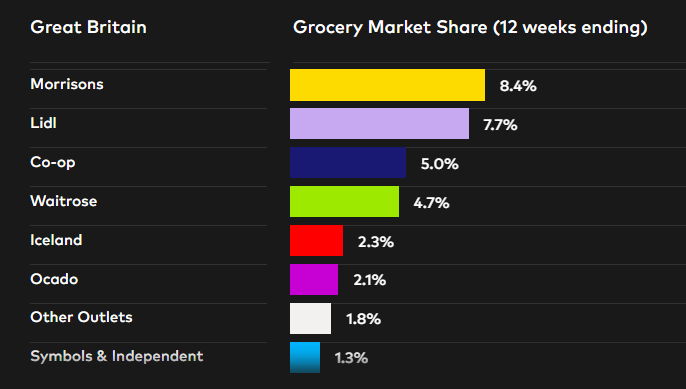

In terms of retailer performance, discounters and online grocers featured prominently. Lidl was among the fastest-growing physical retailers in recent weeks, while Ocado continued to expand its online market share. Traditional supermarket chains posted mixed results, reflecting the competitive pressures and changing shopper preferences that are characteristic of the current grocery market.

Source: Worldpanel by Numerator

Broader implications for consumers and retail

The shift in spending habits reflects both economic pressures and evolving consumer priorities. While lower grocery price inflation has provided some breathing room for household budgets, shoppers are still navigating tighter financial conditions compared with pre-pandemic years, prompting them to be more discerning in their choices. High-protein, high-fibre foods and own-label products have become mainstream components of the grocery basket rather than niche categories.

Retailers, in turn, are adapting their offers to align with these trends by expanding value ranges and promoting healthier options that resonate with consumer priorities around wellness and affordability. The combination of mild inflation, tactical spending, and nutritional focus could influence retail strategies as the industry moves into the spring season.

For policymakers and analysts, the consumer response in early 2026 provides insight into how households balance cost pressures with lifestyle goals — a dynamic that is likely to persist as inflationary trends evolve throughout the year.