Now Reading: Kenya Enters “Electionomics” as 2027 Countdown Triggers Economic Split

-

01

Kenya Enters “Electionomics” as 2027 Countdown Triggers Economic Split

Kenya Enters “Electionomics” as 2027 Countdown Triggers Economic Split

Kenyan businesses are slamming the brakes on major investments while the government floors the accelerator on public spending, as the nation enters the volatile one-year countdown to the August 2027 General Election. This stark divergence, a classic feature of “electionomics,” is setting the stage for a year of economic tension, currency uncertainty, and a high-stakes race for political visibility.

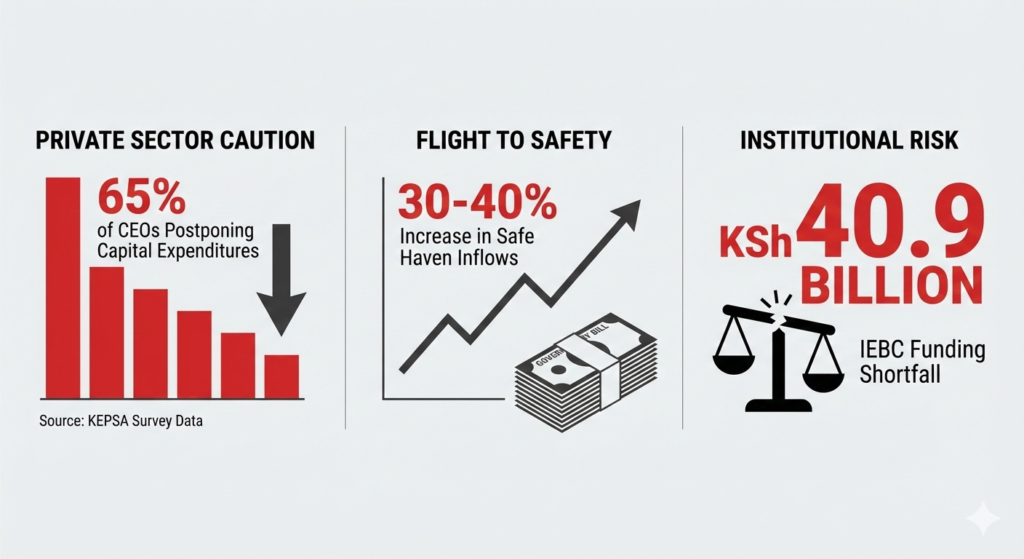

The immediate signs are clear in the boardrooms. A Kenya Private Sector Alliance (KEPSA) survey reveals a full 65% of CEOs are postponing major capital expenditures planned for late 2026 and 2027. This strategic freeze is a direct response to decades of cyclical pre-election volatility, where policy uncertainty and delayed government payments become the norm.

“The playbook for 2026 is defensive preservation, not aggressive expansion,” said a Nairobi-based CFO for a major manufacturing firm, who spoke on condition of anonymity. “We are conserving cash and completing existing projects, but groundbreaking on anything new is on hold until the political air clears.”

The Great Investment Freeze

This corporate caution is quantifiable across several fronts. Historically, credit for large-scale projects plunges by 15-20% in the quarters preceding an election, according to Central Bank of Kenya (CBK) data. Simultaneously, a flight to safety is underway in financial markets.

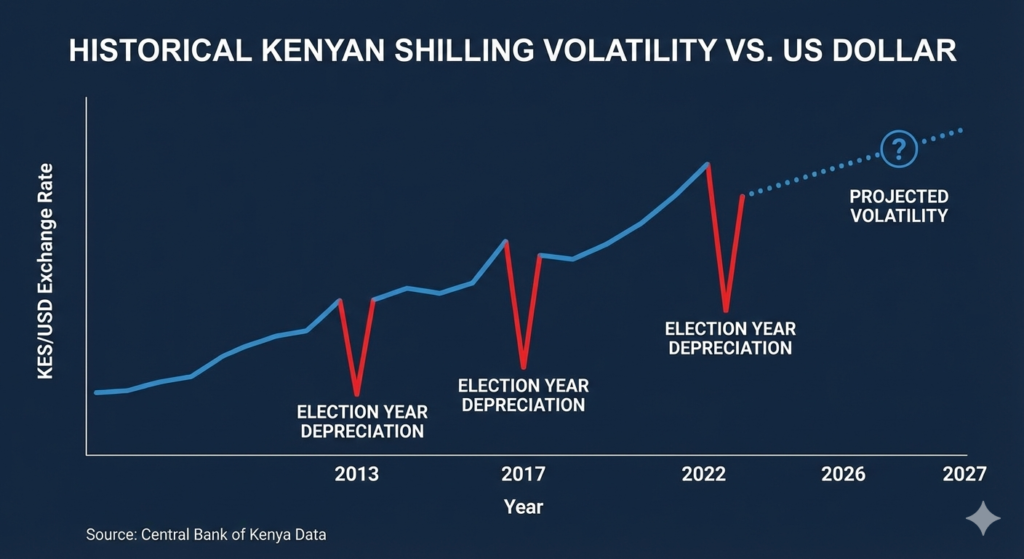

Asset managers report clients are shifting portfolios, with holdings in “safe haven” government Treasury bills and money market funds seeing inflows that typically swell by 30-40% in an election year. The driving fear is twofold: the historical volatility of the Nairobi Securities Exchange during political heats, and the Kenyan Shilling’s well-documented vulnerability.

The Shilling has weakened in three of the last four election cycles. In anticipation, corporate treasury departments are actively hedging. Major banks report a 25% spike in inquiries for US Dollar forward contracts and instruments in the second quarter of 2026 alone, as businesses seek to shield their purchasing power.

The Government’s Spending Sprint

In stark contrast, state machinery is shifting into overdrive. The administration of President William Ruto is prioritizing a “legacy project” blitz, aiming for a ribbon-cutting crescendo by late 2027. The upcoming 2026/27 budget is projected to boost infrastructure spending by 10-15%, heavily weighted toward flagship roads and energy projects.

The political calculus is transparent. “Every completed kilometer of tarmac is a potential campaign poster,” noted political analyst Agnes Muthoni. “The goal is to create an undeniable landscape of physical progress that voters can see and touch before they go to the polls.”

This spending sprint, however, creates a severe fiscal tug-of-war. Election years historically see a 3-5 percentage point surge in populist, discretionary spending—often on subsidies or tax relief—which risks colliding with Kenya’s commitments to international lenders on debt management and deficit reduction.

Mounting Risks and Institutional Pressures

Beneath this economic split, critical institutional risks are mounting. The most urgent is a KSh 40.9 billion funding shortfall at the Independent Electoral and Boundaries Commission (IEBC). A deficit in the coming budget could cripple voter registration and procurement, threatening the credibility of the electoral process itself.

Concurrently, regulatory uncertainty is stifling long-term planning. The Institute of Economic Affairs’ index of policy predictability has fallen 22 points since January 2026, reflecting business fears of sudden regulatory reversals as political alliances shift.

Furthermore, essential supply chains are on high alert. The Energy and Petroleum Regulatory Authority (EPRA) is conducting weekly reserve checks, modeling shows that even a five-day fuel supply disruption during peak campaigning could paralyze transport and manufacturing.

“The goal is to firewall the economy’s essential lifelines from political shocks,” an EPRA official stated. “We are in prevention mode.”

Also Read: Banking Becomes Part of Everyday Life in Kenya

‘A Blatant Attack on Growth’

The private sector views the government’s accelerated spending with a mix of anxiety and frustration. While it may boost short-term activity in construction, it amplifies macro-economic risks.

“This is a blatant attack on sustainable, private sector-led growth,” argued James Mwangi, Chairman of the Kenya Association of Manufacturers. “It pours capital into politically-chosen projects while the policies that would enable thousands of smaller businesses to invest and hire remain unstable. It crowds us out and heightens the very volatility we fear.”

The Central Bank of Kenya now finds itself in a precarious position, caught in the crossfire. It faces intensifying political pressure to cut interest rates and stimulate cheap credit ahead of the polls, a move that could undermine its fight against inflation and trigger further shilling weakness.

“This is the ultimate test of the CBK’s independence,” said investment banker Lydia Omondi. “Its decisions in the next three Monetary Policy Committee meetings will signal whether economic fundamentals or political expediency will guide the year.”

The Corporate Survival Strategy

The unanimous advice from economists and consultants to businesses is to prioritize resilience. Firms are being urged to build liquidity buffers capable of covering 6 to 12 months of operational expenses to survive expected payment delays.

Diversification is also key. Companies dependent on a single government ministry or client are seen as highly vulnerable. “The businesses that will thrive are those with agile, apolitical income streams and fortified balance sheets,” said risk consultant Michael Okoth. “This is a year for endurance, not expansion.”

As Kenya steps into this tense twelve-month corridor, the nation’s economy is effectively bifurcating. One path, paved with public money, races toward a political finish line. The other, lined with private capital, has chosen to wait patiently at the side of the road. The interplay between these two forces will define Kenya’s economic stability long after the last vote is cast in August 2027.