NSE M-Pesa share trading represents a structural inflection point for Kenya’s capital markets, with digital integration poised to unlock deeper liquidity, broaden participation and sustain long-term growth.

- Home

- NewsDelivers timely and breaking business news from Kenya, Africa, and around the globe. Our reports provide the essential updates that professionals need to stay informed.

- Africa Business NewsDelivers pan-African economic and corporate news, highlighting regional trade, integration, and investment opportunities. Focuses on stories impacting the continent’s business landscape.

- Global NewsCurates the most important international business and economic news with relevance to Kenya. Provides a global context for local decision-making.

- Kenya Business NewsThe core of our reporting, delivering essential and timely business news from across the Kenyan economy. Covers deals, policy, and market-moving local events.

- IndustryComprehensive coverage of specific business sectors that power the Kenyan economy. Provides news, trends, and analysis from real estate and tourism to agriculture and aviation.

- AgricultureFollows agribusiness, value chains, and policy developments in Kenya’s agricultural sector. Covers everything from smallholder farming to large-scale export ventures.

- AutoFollows developments in Kenya’s automotive industry, including vehicle sales, dealerships, and manufacturing ventures. Covers trends in mobility and electric vehicles.

- AviationCovers the business of airlines, airports, and regulatory developments in Kenya’s aviation sector. Reports on travel trends, cargo logistics, and industry competition.

- BankingProvides focused coverage of Kenya’s banking sector, including financial results, digital innovation, and regulatory shifts. Tracks competition and lending trends.

- EducationCovers the business of education, including private sector investment, edtech, and university-industry linkages. Analyzes trends in skills development and the education market.

- HealthFocuses on the business, policy, and innovation within Kenya’s healthcare and pharmaceutical industries. Reports on hospital management, health tech, and medical investments.

- Oil and EnergyReports on exploration, production, and the business dynamics within Kenya’s oil, gas, and renewable energy sectors. Tracks key projects and regulatory changes.

- Real EstateTracks developments, trends, and investment opportunities in Kenya’s property and construction sectors. Covers commercial, residential, and industrial real estate markets.

- SMEDedicated to news, challenges, and opportunities for Kenya’s small and medium-sized enterprises. Features founder stories, financing advice, and policy updates.

- TourismFollows the recovery, trends, and business of Kenya’s vital tourism and hospitality industry. Reports on travel, hotels, conservation, and safari ventures.

- MarketsFocuses on the performance and dynamics of the Nairobi Securities Exchange and other financial markets. Delivers updates on stocks, bonds, commodities, and investor sentiment.

- TechnologyCovers the digital shifts, innovations, and startups shaping Kenya’s business future. Reports on AI, fintech, telecoms, e-commerce, and the broader digital economy.

- AIDedicated to covering the development, application, and impact of artificial intelligence in Kenya’s economy. Tracks startups, enterprise adoption, and ethical debates.

- GadgetsCovers the latest consumer electronics, devices, and tech hardware entering the Kenyan market. Provides reviews and news on product launches and trends.

- Tech NewsReports on breaking news, updates, and major announcements within Kenya’s broader technology sector. Covers everything from startup funding to regulatory changes.

- EconomyProvides authoritative coverage of the forces shaping Kenya’s economic and financial environment. Tracks policy, markets, banking, inflation, and trade to deliver data-driven insights for decision-makers. With a strong focus on trade and exports, this page offers timely analysis, data-driven insights, and expert perspectives to help business leaders, investors, and decision-makers understand market trends, assess risks, and identify opportunities in Kenya and the wider global economy.

- FinanceReports on corporate performance, industry developments, and major sectors like energy and real estate. Offers analysis on company results, leadership, and strategic shifts driving Kenya’s corporate growth.

- AnalysisIn-depth storytelling and investigative journalism on Kenya’s business landscape. We deliver deep dives, detailed investigations, and expert insights that go beyond standard reporting.

- OpinionA platform for expert commentary, editorial perspectives, and thought leadership on Kenya’s business and economic issues. Features columns, editorials, and special guest essays.

- ColumnsRegular opinion pieces from our stable of expert columnists on business, finance, and the economy. Offers seasoned perspectives and critical analysis.

- EditorialsRepresents the institutional voice and stance of Business Kenya News on major economic and business issues. Provides reasoned argument and calls to action.

- SpecialsFeature-length, in-depth reports and investigative series on significant topics or events. Offers comprehensive storytelling beyond daily news cycles.

- Home

- NewsDelivers timely and breaking business news from Kenya, Africa, and around the globe. Our reports provide the essential updates that professionals need to stay informed.

- Africa Business NewsDelivers pan-African economic and corporate news, highlighting regional trade, integration, and investment opportunities. Focuses on stories impacting the continent’s business landscape.

- Global NewsCurates the most important international business and economic news with relevance to Kenya. Provides a global context for local decision-making.

- Kenya Business NewsThe core of our reporting, delivering essential and timely business news from across the Kenyan economy. Covers deals, policy, and market-moving local events.

- IndustryComprehensive coverage of specific business sectors that power the Kenyan economy. Provides news, trends, and analysis from real estate and tourism to agriculture and aviation.

- AgricultureFollows agribusiness, value chains, and policy developments in Kenya’s agricultural sector. Covers everything from smallholder farming to large-scale export ventures.

- AutoFollows developments in Kenya’s automotive industry, including vehicle sales, dealerships, and manufacturing ventures. Covers trends in mobility and electric vehicles.

- AviationCovers the business of airlines, airports, and regulatory developments in Kenya’s aviation sector. Reports on travel trends, cargo logistics, and industry competition.

- BankingProvides focused coverage of Kenya’s banking sector, including financial results, digital innovation, and regulatory shifts. Tracks competition and lending trends.

- EducationCovers the business of education, including private sector investment, edtech, and university-industry linkages. Analyzes trends in skills development and the education market.

- HealthFocuses on the business, policy, and innovation within Kenya’s healthcare and pharmaceutical industries. Reports on hospital management, health tech, and medical investments.

- Oil and EnergyReports on exploration, production, and the business dynamics within Kenya’s oil, gas, and renewable energy sectors. Tracks key projects and regulatory changes.

- Real EstateTracks developments, trends, and investment opportunities in Kenya’s property and construction sectors. Covers commercial, residential, and industrial real estate markets.

- SMEDedicated to news, challenges, and opportunities for Kenya’s small and medium-sized enterprises. Features founder stories, financing advice, and policy updates.

- TourismFollows the recovery, trends, and business of Kenya’s vital tourism and hospitality industry. Reports on travel, hotels, conservation, and safari ventures.

- MarketsFocuses on the performance and dynamics of the Nairobi Securities Exchange and other financial markets. Delivers updates on stocks, bonds, commodities, and investor sentiment.

- TechnologyCovers the digital shifts, innovations, and startups shaping Kenya’s business future. Reports on AI, fintech, telecoms, e-commerce, and the broader digital economy.

- AIDedicated to covering the development, application, and impact of artificial intelligence in Kenya’s economy. Tracks startups, enterprise adoption, and ethical debates.

- GadgetsCovers the latest consumer electronics, devices, and tech hardware entering the Kenyan market. Provides reviews and news on product launches and trends.

- Tech NewsReports on breaking news, updates, and major announcements within Kenya’s broader technology sector. Covers everything from startup funding to regulatory changes.

- EconomyProvides authoritative coverage of the forces shaping Kenya’s economic and financial environment. Tracks policy, markets, banking, inflation, and trade to deliver data-driven insights for decision-makers. With a strong focus on trade and exports, this page offers timely analysis, data-driven insights, and expert perspectives to help business leaders, investors, and decision-makers understand market trends, assess risks, and identify opportunities in Kenya and the wider global economy.

- FinanceReports on corporate performance, industry developments, and major sectors like energy and real estate. Offers analysis on company results, leadership, and strategic shifts driving Kenya’s corporate growth.

- AnalysisIn-depth storytelling and investigative journalism on Kenya’s business landscape. We deliver deep dives, detailed investigations, and expert insights that go beyond standard reporting.

- OpinionA platform for expert commentary, editorial perspectives, and thought leadership on Kenya’s business and economic issues. Features columns, editorials, and special guest essays.

- ColumnsRegular opinion pieces from our stable of expert columnists on business, finance, and the economy. Offers seasoned perspectives and critical analysis.

- EditorialsRepresents the institutional voice and stance of Business Kenya News on major economic and business issues. Provides reasoned argument and calls to action.

- SpecialsFeature-length, in-depth reports and investigative series on significant topics or events. Offers comprehensive storytelling beyond daily news cycles.

- Home//

- News//Delivers timely and breaking business news from Kenya, Africa, and around the globe. Our reports provide the essential updates that professionals need to stay informed.

- Africa Business News//Delivers pan-African economic and corporate news, highlighting regional trade, integration, and investment opportunities. Focuses on stories impacting the continent’s business landscape.

- Global News//Curates the most important international business and economic news with relevance to Kenya. Provides a global context for local decision-making.

- Kenya Business News//The core of our reporting, delivering essential and timely business news from across the Kenyan economy. Covers deals, policy, and market-moving local events.

- Industry//Comprehensive coverage of specific business sectors that power the Kenyan economy. Provides news, trends, and analysis from real estate and tourism to agriculture and aviation.

- Agriculture//Follows agribusiness, value chains, and policy developments in Kenya’s agricultural sector. Covers everything from smallholder farming to large-scale export ventures.

- Auto//Follows developments in Kenya’s automotive industry, including vehicle sales, dealerships, and manufacturing ventures. Covers trends in mobility and electric vehicles.

- Aviation//Covers the business of airlines, airports, and regulatory developments in Kenya’s aviation sector. Reports on travel trends, cargo logistics, and industry competition.

- Banking//Provides focused coverage of Kenya’s banking sector, including financial results, digital innovation, and regulatory shifts. Tracks competition and lending trends.

- Education//Covers the business of education, including private sector investment, edtech, and university-industry linkages. Analyzes trends in skills development and the education market.

- Health//Focuses on the business, policy, and innovation within Kenya’s healthcare and pharmaceutical industries. Reports on hospital management, health tech, and medical investments.

- Oil and Energy//Reports on exploration, production, and the business dynamics within Kenya’s oil, gas, and renewable energy sectors. Tracks key projects and regulatory changes.

- Real Estate//Tracks developments, trends, and investment opportunities in Kenya’s property and construction sectors. Covers commercial, residential, and industrial real estate markets.

- SME//Dedicated to news, challenges, and opportunities for Kenya’s small and medium-sized enterprises. Features founder stories, financing advice, and policy updates.

- Tourism//Follows the recovery, trends, and business of Kenya’s vital tourism and hospitality industry. Reports on travel, hotels, conservation, and safari ventures.

- Markets//Focuses on the performance and dynamics of the Nairobi Securities Exchange and other financial markets. Delivers updates on stocks, bonds, commodities, and investor sentiment.

- Technology//Covers the digital shifts, innovations, and startups shaping Kenya’s business future. Reports on AI, fintech, telecoms, e-commerce, and the broader digital economy.

- AI//Dedicated to covering the development, application, and impact of artificial intelligence in Kenya’s economy. Tracks startups, enterprise adoption, and ethical debates.

- Gadgets//Covers the latest consumer electronics, devices, and tech hardware entering the Kenyan market. Provides reviews and news on product launches and trends.

- Tech News//Reports on breaking news, updates, and major announcements within Kenya’s broader technology sector. Covers everything from startup funding to regulatory changes.

- Economy//Provides authoritative coverage of the forces shaping Kenya’s economic and financial environment. Tracks policy, markets, banking, inflation, and trade to deliver data-driven insights for decision-makers. With a strong focus on trade and exports, this page offers timely analysis, data-driven insights, and expert perspectives to help business leaders, investors, and decision-makers understand market trends, assess risks, and identify opportunities in Kenya and the wider global economy.

- Finance//Reports on corporate performance, industry developments, and major sectors like energy and real estate. Offers analysis on company results, leadership, and strategic shifts driving Kenya’s corporate growth.

- Analysis//In-depth storytelling and investigative journalism on Kenya’s business landscape. We deliver deep dives, detailed investigations, and expert insights that go beyond standard reporting.

- Opinion//A platform for expert commentary, editorial perspectives, and thought leadership on Kenya’s business and economic issues. Features columns, editorials, and special guest essays.

- Columns//Regular opinion pieces from our stable of expert columnists on business, finance, and the economy. Offers seasoned perspectives and critical analysis.

- Editorials//Represents the institutional voice and stance of Business Kenya News on major economic and business issues. Provides reasoned argument and calls to action.

- Specials//Feature-length, in-depth reports and investigative series on significant topics or events. Offers comprehensive storytelling beyond daily news cycles.

Markets

Focuses on the performance and dynamics of the Nairobi Securities Exchange and other financial markets. Delivers updates on stocks, bonds, commodities, and investor sentiment.

- Home

- Markets

MarketsYesterday

Kenya economic growth is forecast at 5.3% in 2026, but debt pressures, climate shocks and fiscal discipline will determine the durability of recovery.

Uncategorized2 days ago

Kenya’s Research-to-Commercialisation programme unlocks Sh604 million in three years.

Markets3 days ago

Kenya shoe imports have surged dramatically — rising 63 percent in recent months — as local manufacturers grapple with production challenges, high input costs and stiff competition from cheaper foreign products.

Markets4 days ago

Kenya seeks IMF support to stabilize public finances as debt servicing costs rise and fiscal pressures mount.

Markets1 week ago

AMAC is a quiet NSE stock offering steady growth and real investment value in the food and consumer goods sector.

Markets1 week ago

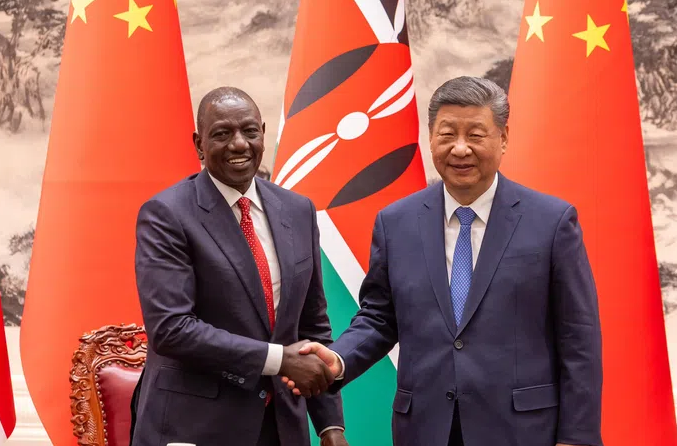

Kenya’s duty-free trade deal with China opens substantial export opportunities and supports diversification of the country’s export basket.

Markets1 week ago

Nigeria’s EV deal signals a strategic shift from vehicle imports to large-scale electric vehicle manufacturing.

Markets1 week ago

Kenyan farmers are shifting to informal and digital credit as banks and Saccos become less accessible.

Markets1 week ago

A closer look at why low prices often reflect risk, not opportunity, in modern financial markets.

- 1

- 2

Recent Posts

- Malawi aims to cut inflation below 21% with IMF support

- Why Sameer Naushad Merali Is Considered One of Kenya’s Richest and Most Strategic Business Titans

- Eveready Targets Solar and E-Mobility in Strategic Reset

- Powerful PAYE Proposal Could Boost Kenyans’ Take-Home Pay Significantly

- Wananchi Group Insolvency Demand Raises Fibre Market Concerns

Recent Comments