Now Reading: Kenya–China Trade Deal Heralds Export Boost with Zero-Duty Access

-

01

Kenya–China Trade Deal Heralds Export Boost with Zero-Duty Access

Kenya–China Trade Deal Heralds Export Boost with Zero-Duty Access

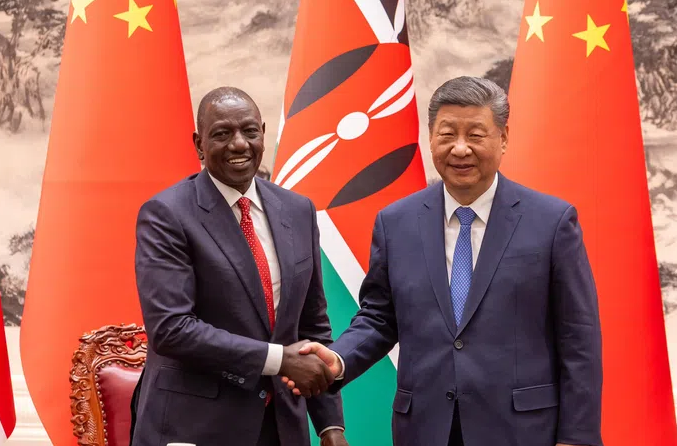

A new Kenya–China trade deal is set to significantly expand market access for Kenyan goods after the two countries agreed to a preliminary framework granting 98.2 % zero-duty access to Chinese markets for Kenyan exports. The arrangement — seen as a strategic shift toward balancing a long-standing trade deficit and diversifying export destinations — is expected to unlock fresh opportunities across sectors such as agriculture, agro-processing, and value-added manufacturing while strengthening bilateral economic ties.

How the Kenya–China trade deal expands export opportunities

Kenya and China agreed in mid-January 2026 on what officials have termed an “early harvest” phase of a broader trade pact that allows most Kenyan products to enter China’s vast consumer market with zero duties. Under the framework, approximately 98.2 % of Kenyan exports — including tea, coffee, horticultural produce, and processed foods — will be eligible for tariff-free entry, easing longstanding trade barriers and enhancing competitiveness compared with other suppliers.

Trade Cabinet Secretary Lee Kinyanjui said the agreement corrects a structural disadvantage that previously kept Kenyan exporters at a competitive disadvantage relative to East African neighbors that enjoyed preferential access under China’s duty-free and quota-free regime for least developed countries. By negotiating terms that mirror those benefits, Kenya aims to level the playing field and expand its reach in a market of more than 1.4 billion consumers.

Related Post: Nigeria Secures Landmark Electric Vehicle Manufacturing Deal with South Korea

The deal also reflects broader aims to diversify Kenya’s export markets beyond traditional destinations such as Europe and North America, particularly as geopolitical and tariff pressures — like changes to the African Growth and Opportunity Act — create uncertainty in some markets. Exporters and policymakers see China as a strategic partner for expanding volumes and tapping into demand for agricultural and light-manufactured goods.

Economic implications and incentives for Kenyan industries

The Kenya–China trade deal is expected to have wide-ranging economic effects, particularly for agriculture and value-added industries. Duty-free access can reduce the cost burden on exporters, making products like avocados, tea, and coffee more price-competitive compared with producers from other regions. This could stimulate output, encourage value addition, and help Kenyan companies move up the global value chain.

Agriculture remains the backbone of Kenya’s economy and a primary source of employment. With reduced tariffs, farmers and agribusinesses may find it easier to scale production and diversify their product baskets. For example, processed foods and horticultural exports — which command higher margins than unprocessed commodities — could see more traction in China’s dynamic market.

Beyond agriculture, the deal may draw investment into export-oriented sectors such as leather goods, textiles, and light manufacturing. Investors often look for stable, market-friendly trade regimes as a precursor to long-term commitments in facilities, logistics, and quality assurance capabilities tied to export performance. Strengthened trade links with China could therefore catalyze industrial development and job creation in related industries.

The Kenya–China trade deal can also strengthen foreign exchange earnings, support industrialization goals, and improve Kenya’s position in global trade negotiations. Export growth, if realized, could help narrow the trade imbalance with China that has historically favored imports of capital and manufactured goods.

In addition, deeper engagement with China’s vast consumer base may encourage Kenyan businesses to innovate, adopt higher value-added production models, and expand their footprint in Asia. Such diversification aligns with national economic frameworks aiming to drive export-led growth and sustainable economic transformation.