Now Reading: Lending Rates Fall as Equity, KCB, NCBA Follow CBK Cut

-

01

Lending Rates Fall as Equity, KCB, NCBA Follow CBK Cut

Lending Rates Fall as Equity, KCB, NCBA Follow CBK Cut

Lending rates at Kenya’s biggest banks are easing again after the Central Bank of Kenya lowered its benchmark rate, offering borrowers modest relief while signalling a sustained shift toward cheaper credit.

Equity Bank Kenya, KCB Bank Kenya and NCBA Bank Kenya have all confirmed reductions in their base lending to 8.75 per cent following the Central Bank of Kenya’s decision to cut the Central Bank Rate (CBR) from 9.00 per cent to 8.75 per cent on February 10, 2026.

The move tightens the link between bank lending rates and monetary policy, reinforcing the risk-based credit pricing model that now anchors most Kenyan shilling variable-rate loans to the CBR plus a customer-specific premium.

For borrowers, the immediate takeaway is simple: new variable-rate loans will now be cheaper, while existing loans tied to the CBR will gradually adjust downward over the next month

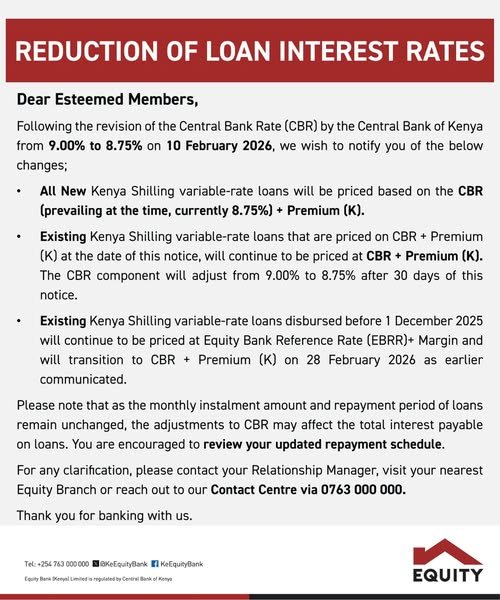

Equity Bank was among the first lenders to formally notify customers of the changes. In a notice dated February 10, the bank said all new Kenya shilling variable-rate loans will now be priced at the prevailing CBR of 8.75 per cent plus a premium that reflects the borrower’s risk profile.

For customers with existing variable-rate loans already linked to the CBR, the bank said the benchmark component will fall from 9.00 per cent to 8.75 per cent after the mandatory 30-day notice period.

Loans issued before December 1, 2025, and still priced on the Equity Bank Reference Rate (EBRR) will transition to the CBR-based framework on February 28, 2026.

Equity clarified that monthly instalments and loan tenors will not change, but the lower benchmark could reduce the total interest paid over the life of a loan. Customers have been advised to review updated repayment schedules to understand the full impact.

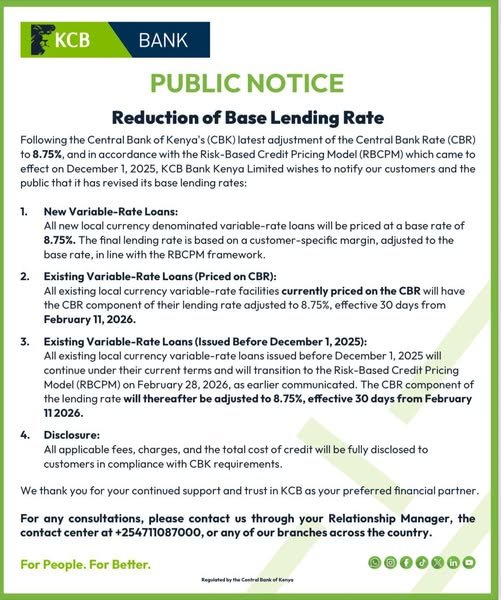

KCB Bank has adopted a similar approach. The lender said all new local-currency variable-rate loans will be priced at a base rate of 8.75 per cent, with a customer-specific margin applied under the risk-based pricing model.

Existing facilities already linked to the CBR will see the benchmark adjust downward after the notice period, while loans issued before December 1, 2025, will migrate to the new framework at the end of February, with repricing effective from March.

NCBA has also joined the repricing cycle. The bank said new Kenya shilling variable-rate loans booked from February 12 will apply a base rate of 8.75 per cent per annum. Facilities granted under the revised pricing model since December will adjust in March, while older loans will transition to the CBR-linked structure later this month.

Together, Equity, KCB and NCBA account for a large share of Kenya’s banking assets and private-sector lending, meaning their decisions carry broad influence across the economy.

What New Lending Rates mean for borrowers

While the headline drop in lending rates is relatively small-just 25 basis points-it reinforces a longer easing cycle that has now seen ten consecutive CBR cuts since August 2024.

For households and businesses, especially those with variable-rate loans, the gradual decline can add up over time. Lower lending rates reduce interest costs, improve cash flow and can make new borrowing more attractive, particularly for working capital and expansion.

However, banks have been clear that the final lending rate still depends on individual risk assessments. This means borrowers with stronger credit profiles are likely to feel the benefits more quickly than those seen as higher risk.

Policy signal from the CBK

The rate cut by the Central Bank of Kenya reflects confidence that inflation is under control and the exchange rate is stable enough to support cheaper credit. The regulator has said the goal is to stimulate private-sector lending while keeping inflation expectations anchored.

As banks continue to align lending rates closely with the CBR, borrowers can expect future policy decisions to feed more predictably into loan pricing, a shift that makes the cost of credit easier to track, even if relief comes in small steps rather than dramatic drops.

Read Also: CBK Cuts Benchmark Rate to 8.75% to Boost Lending – Business News