Now Reading: How Kenyans Are Coping with the Rising Cost of Living

-

01

How Kenyans Are Coping with the Rising Cost of Living

How Kenyans Are Coping with the Rising Cost of Living

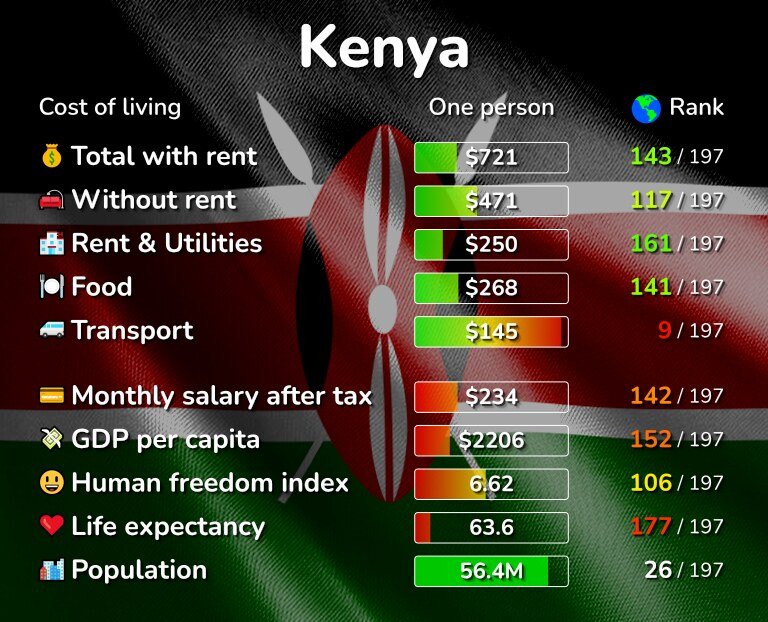

As 2026 unfolds, Kenyans continue to feel the pinch of a high cost of living as everyday expenses for food, energy, and transport strain household budgets.

While headline inflation remains relatively stable, the reality on the ground is stark; many families are struggling to make ends meet.

Recent data from the Kenya National Bureau of Statistics (KNBS) shows that essentials like vegetables, maize flour, and cooking oil have risen significantly, while fuel and electricity costs remain elevated despite slightly positive market shifts with easing inflation.

To cope with the rising cost of living, a growing number of Kenyans are turning to a number of tactics.

In urban areas, common strategies include running small retail stalls, offering boda boda transport services, freelancing online, or providing home-based services such as tailoring, hairdressing, or food delivery.

Others sell second-hand goods online or offer digital skills like graphic design, tutoring, or social media management.

Today, it is not rare to witness creative solutions like home vegetable gardens, bulk cooking, and shared rides among fellows in Nairobi and other major cities and towns.

Survey shows that approximately half of the residents report seeking additional income sources to buffer their household budgets in Nairobi and the Rift Valley alone.

On the other hand, rural families are turning to small-scale farming, selling surplus produce at local markets to supplement income.

Adjustments to daily routines are also common

According to an Infotrak survey, nearly 41% of Kenyans reported reducing non-essential expenditure, while others have reduced energy consumption, switched to cheaper transport options, or cut down on eating out.

To add on that, financial tools such as microloans, mobile lending apps, and informal savings groups (chamas) are also playing a role in helping families manage cash flow and deal with unexpected expenses.

However, even though these coping mechanisms reflect resilience, they are mostly stopgap measures rather than long-term solutions.

The Kenyan public continues to express concerns about the rising cost of education, fuel, and food, highlighting the need for policy interventions.

In other words, while side hustles and careful budgeting provide immediate relief, long-term stability will depend on economic policies that address wage growth, job creation, and affordable access to essential goods.

As households innovate to survive, it is clear that Kenyans are drawing on resourcefulness, community support, and entrepreneurial spirit to navigate an increasingly expensive economy.

Read Also: Why Kenya’s House Prices Are Rising Faster Than Incomes – Business News