Malawi is targeting inflation below 21% this year as the government pursues IMF-backed reforms to stabilise prices, ease foreign exchange shortages, and restore economic growth.

Economy

Provides authoritative coverage of the forces shaping Kenya’s economic and financial environment. Tracks policy, markets, banking, inflation, and trade to deliver data-driven insights for decision-makers.

With a strong focus on trade and exports, this page offers timely analysis, data-driven insights, and expert perspectives to help business leaders, investors, and decision-makers understand market trends, assess risks, and identify opportunities in Kenya and the wider global economy.

CMA approves a new batch of market intermediaries in a move aimed at widening investment choices for Kenyans, boosting competition, and deepening the country’s capital markets.

KCB Bank’s latest investment in the 2026 Safari Rally underscores how the event has evolved into a catalyst for local economic growth, talent development and sustainability initiatives.

Kenyans are turning to side hustles, careful budgeting, and community support to cope with soaring living costs in 2026.

Dividends from Safaricom and other blue-chip firms have propelled the NSE to a record high, signalling renewed investor confidence as strong earnings translate into rising market wealth.

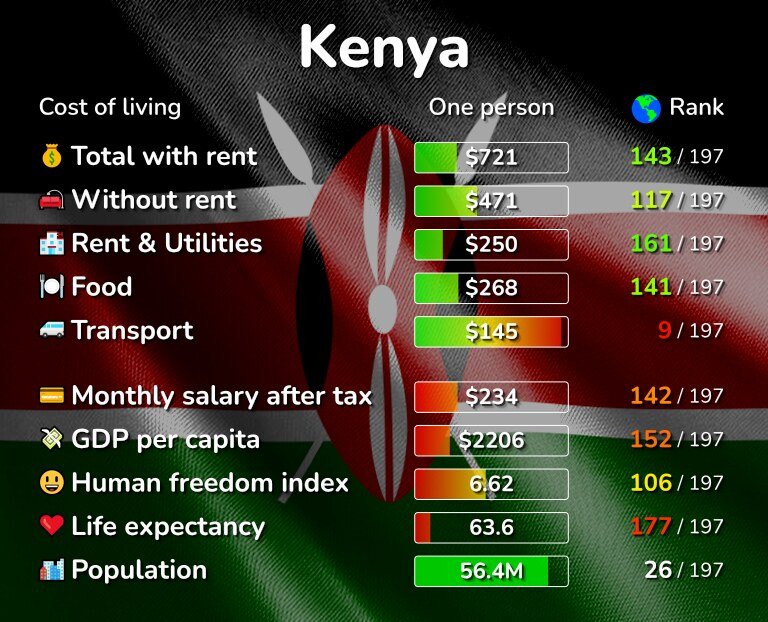

Despite falling headline inflation, Kenyan households continue to struggle as soaring food, transport, and housing costs outpace stagnant incomes, keeping the cost of living stubbornly high.

The AGOA extension offers African short-term relief, but long-term stability depends on diversifying export markets.

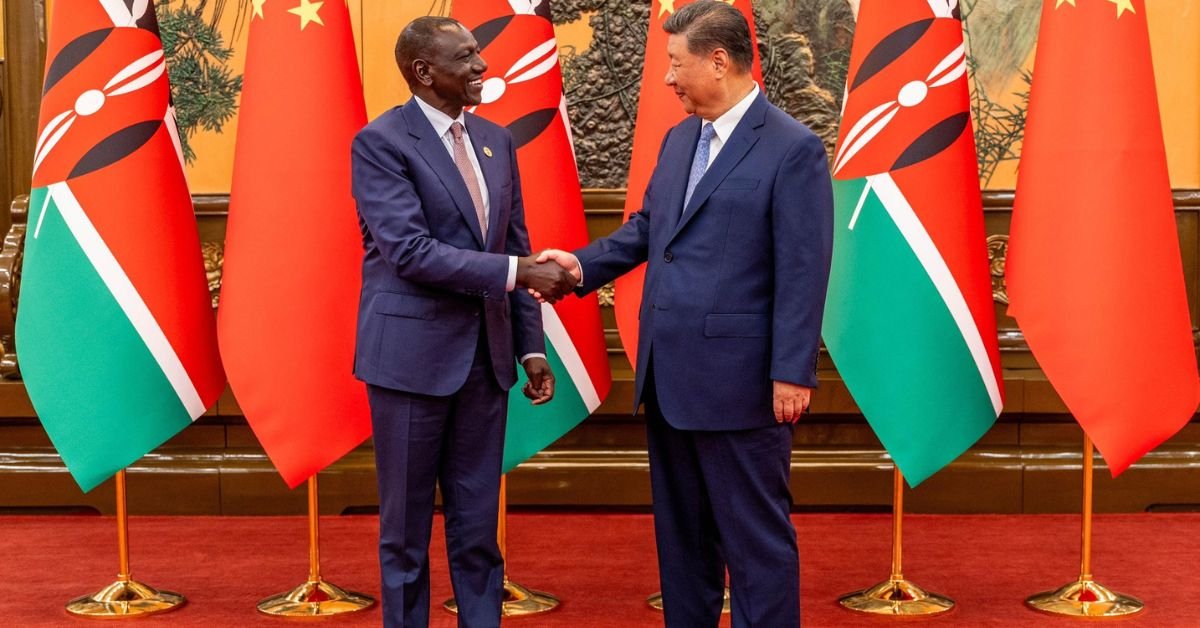

Kenya is set to sign a duty-free China deal in 30 days, giving farmers and exporters unrestricted access to a market of 1.4 billion consumers and boosting the country’s economy.

Kenya’s economic growth is set at 4.9–5.2% in 2026, supported by stable inflation.

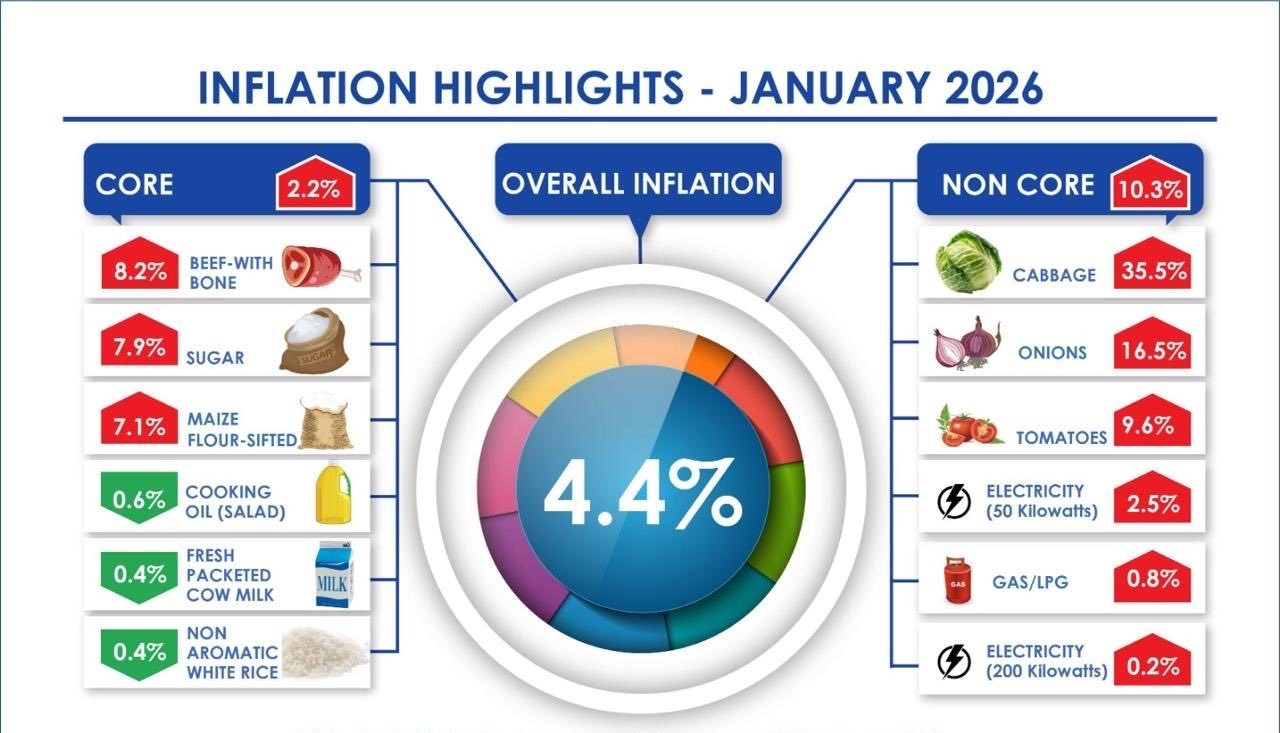

Kenya’s inflation slows to 4.4% in January, easing costs for consumers and stabilising the economic outlook for investors.

- 1

- 2