Now Reading: How M-Pesa’s Ziidi Trader Unlocks NSE Investing for Kenyans

-

01

How M-Pesa’s Ziidi Trader Unlocks NSE Investing for Kenyans

How M-Pesa’s Ziidi Trader Unlocks NSE Investing for Kenyans

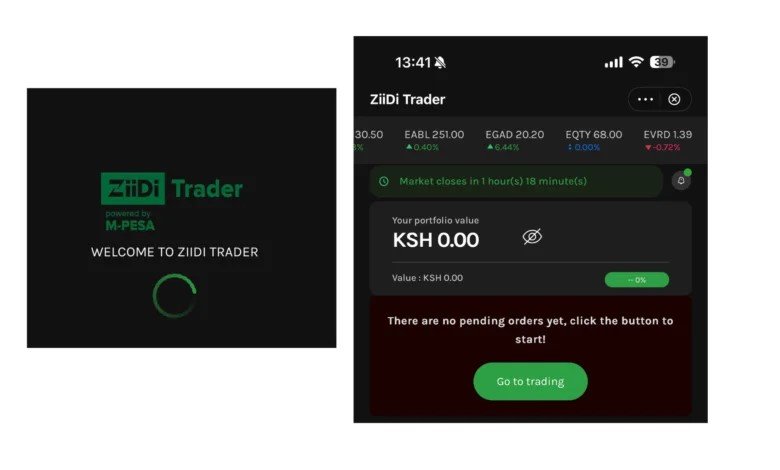

Kenyans can now buy and sell shares listed on the Nairobi Securities Exchange (NSE) directly from their phones after Safaricom activated Ziidi Trader, a new stock-trading feature embedded inside the M-Pesa app, marking one of the most significant shifts in retail investing the country has seen in decades.

The platform allows users to trade NSE-listed stocks without opening a traditional Central Depository System (CDS) account or visiting a stockbroker, with daily transactions capped at Sh500,000.

For the first time, equity trading sits alongside airtime purchases, bill payments and peer-to-peer transfers, right inside Kenya’s most widely used financial app.

From M-Pesa payments to investing

Ziidi Trader brings together share buying and selling, portfolio tracking and real-time price monitoring in a single digital interface, eliminating paperwork and physical onboarding.

Ziidi allows investments in NSE-listed companies, where anybody can buy and sell listed shares directly from the M-PESA app.

The process has been significantly simplified, only requiring the user to complete a short digital onboarding process, including declarations on occupation and source of funds, such as employment income, business proceeds, or side hustles.

They then need to acknowledge standard investment risk disclosures, warning that share prices can rise or fall, and they’re free to browse listed companies, place buy or sell orders, pay directly from their M-PESA balance, and track prices and portfolio value in real time.

Funds can only be invested or withdrawn via M-pesa with invested funds instantly accessible.

Safaricom describes the product as flexible and user-driven. “People use the stock market in different ways, and Ziidi Trader gives you the flexibility to decide how and when to trade,” reads an in-app description.

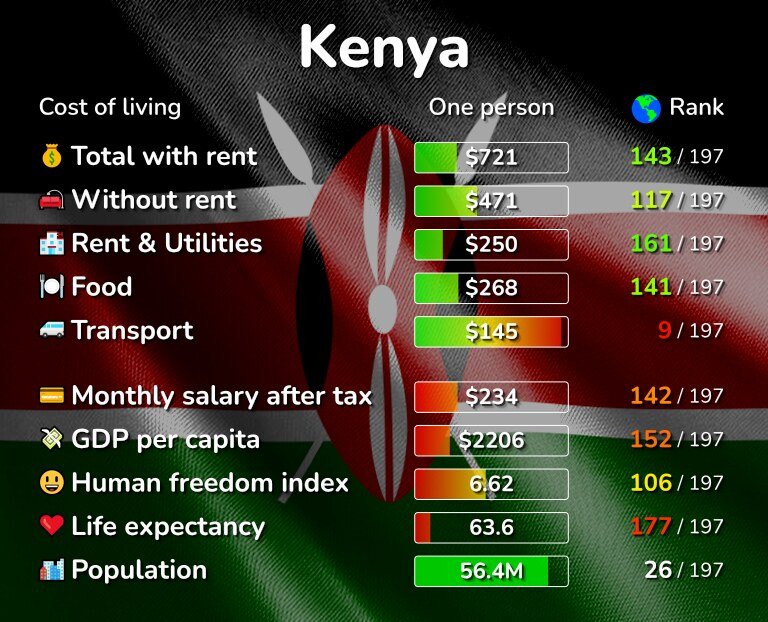

Why M-pesa trading matters now

The rollout comes as the NSE and Safaricom pursue the shared goal of unlocking retail participation in a market long dominated by institutional and foreign investors.

Despite Kenya’s relatively advanced capital markets, retail engagement has remained stubbornly low.

The NSE has about 1.5-1.6 million registered CDS accounts, but industry estimates suggest only a small single-digit percentage trade actively in any given year.

In contrast, Safaricom has over 35 million active M-Pesa users, highlighting a structural gap between where Kenyans hold money and how they access investments.

By integrating equity trading into M-Pesa, the NSE is effectively meeting investors where their liquidity already sits.

NSE Chief Executive Frank Mwiti has previously stated that the strategy aims to grow the number of active retail investors to nine million by 2029, repositioning the exchange as part of everyday financial life rather than a niche institution.

Lower barriers, smaller trades

Ziidi Trader builds on the structural reforms introduced in late 2025, which reshaped how retail investors interact with the market.

Minimum trade sizes have dropped from 100 shares to single-share purchases, onboarding is now fully digital, and settlement times have been compressed to near-instant execution in some cases.

Cost has also been a key hurdle. Traditional brokerage minimum commissions have historically punished small investors, making modest trades uneconomical.

Early cost breakdowns on Ziidi Trader show that a KES 4,500 trade can attract total charges of about KES 68.50, or roughly 1.5%, making micro-investing viable for the first time for many Kenyans.

Its Part of a bigger Ziidi ecosystem

Ziidi Trader is the second pillar of Safaricom’s expanding Ziidi investment ecosystem, anchored by the Ziidi Money Market Fund (MMF) launched in December 2024 in partnership with Standard Investment Bank and ALA Capital.

The MMF allows M-Pesa users to invest from as little as KES 100, earn daily interest and withdraw funds instantly.

By June 30, 2025, the fund had grown assets under management to KES 10.68 billion, attracted more than 1.15 million active investors, and posted a surplus of KES 273.08 million attributable to unit holders, reflecting strong demand for simple, mobile-first investment products.

With Ziidi Trader, Safaricom is moving users from passive savings into active market participation by placing a “Buy” button directly next to money already sitting in mobile wallets.

Risks and questions over M-Pesa trading

While the ease of access is widely seen as a positive, it also raises concerns.

Market observers warn that making stock trading as simple as buying airtime could encourage impulsive or speculative behaviour, particularly among first-time investors unfamiliar with market risks.

There are also regulatory and infrastructure questions, such as how closely M-Pesa transactions will be synchronised with clearing and custody systems, how consumer protection will be enforced through a payments interface, and whether the NSE’s trading systems can handle a surge in retail activity at scale.

Stockbrokers have voiced unease about reduced advisory buffers, though the NSE maintains that brokers will remain central to liquidity provision and regulatory oversight, even as the user experience becomes digital-first.

A turning point for Kenyan markets

For Safaricom, the move reinforces its evolution from a payments company into a wealth-infrastructure platform.

For the NSE, it represents a long-awaited liquidity injection and a chance to reconnect with ordinary Kenyans.

For the everyday investor, Ziidi Trader changes the equation entirely. The stock market is no longer a distant, paperwork-heavy institution; it now lives inside a phone, a few taps away from a mobile wallet.

Read Also: Kenya–China Trade Deal Heralds Export Boost with Zero-Duty Access – Business News