Now Reading: Why Kenya’s Cost of Living Remains Stubbornly High

-

01

Why Kenya’s Cost of Living Remains Stubbornly High

Why Kenya’s Cost of Living Remains Stubbornly High

Reports show Kenya’s inflation rate has eased, and key economic indicators appear stable, yet for millions of households, the cost of living remains painfully high, exposing a widening gap between official statistics and everyday reality.

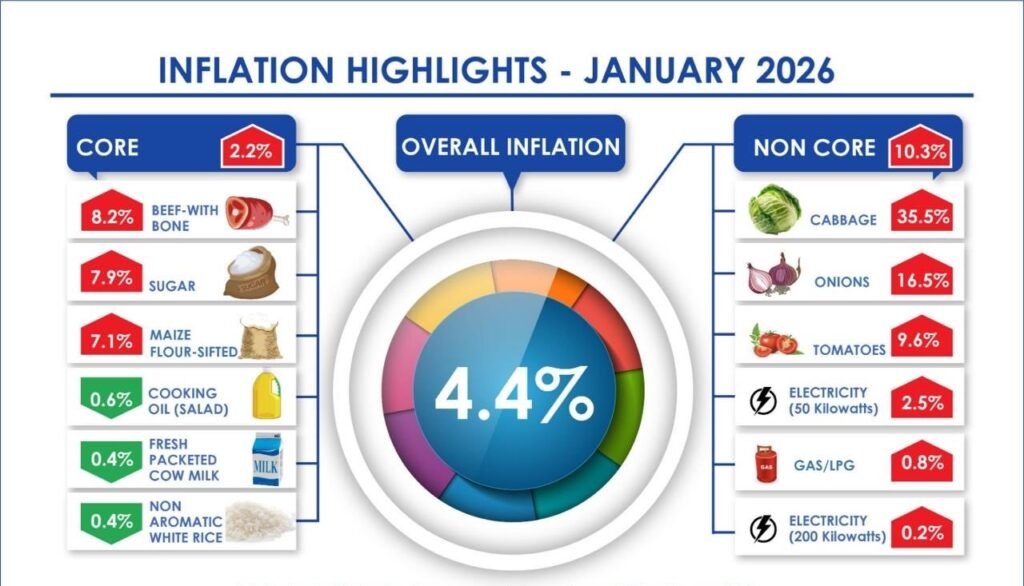

Recent data from the Kenya National Bureau of Statistics (KNBS) shows inflation hovering between 4.4 and 4.6 per cent, well within the Central Bank of Kenya’s target range of 2.5 to 7.5 per cent.

On paper, this suggests prices are rising at a manageable pace. In practice, however, most Kenyan families feel poorer than they did a year ago, struggling to afford food, transport, housing and basic services.

Food and non-alcoholic beverages, which account for nearly a third of household spending, recorded annual increases of between 7 and 8 per cent, contributing to the high cost of living.

Prices of everyday staples have risen sharply: cabbage by over 35 per cent, sukuma wiki by more than 20 per cent, maize flour by up to 16 per cent, and tomatoes by over 30 per cent in some months.

Since these are not discretionary purchases but daily necessities, even modest headline inflation masks intense pressure on household budgets.

Transport costs have added to the high cost of living

While fuel prices have stabilised or declined slightly month-on-month, they remain higher than a year ago, pushing annual transport inflation close to 5 per cent.

Domestic air travel fares jumped by more than 50 per cent year-on-year, while electricity prices for common household consumption levels have also edged higher.

Housing, water and energy costs continue to rise steadily, absorbing an ever-larger share of income and further aggrevating the cost of living.

This explains why many Kenyans feel worse off despite “stable” inflation. Food, transport and housing together make up more than 57 per cent of the inflation basket.

When prices in these categories rise faster than the average, the lived experience of inflation is far harsher than the headline number suggests.

The Issue of stagnant incomes

Wage growth has failed to keep pace with rising prices, particularly in the informal sector, which employs the majority of Kenyans.

KNBS data shows that most new jobs created in recent years have been informal, low-paying and insecure.

When prices stabilise at a higher level, but incomes do not rise, purchasing power continues to erode. Families are forced to cut back, delay school fees, or forego healthcare, deepening the sense of financial distress.

Base effects also play a role in distorting perceptions

Inflation measures the rate of change in prices, not how expensive things already are.

After sharp price increases in previous years, especially for food and fuel, inflation can appear lower simply because prices are being compared to an already high base.

This does not mean goods have become cheaper; it only means they are rising more slowly. For households still paying elevated prices, the relief feels theoretical.

Interest rates add to the high cost of living

Although the Central Bank has begun easing policy, borrowing costs remain high by historical standards.

Elevated lending rates make credit expensive for households and small businesses, limiting investment, job creation and income growth.

Even as rates edge down, access to affordable credit remains uneven, particularly for informal workers and small enterprises seen as high-risk by banks.

How global factors shape the Cost of living challenge

Disruptions to shipping routes, higher insurance and freight costs, and volatile global commodity markets feed into local prices.

While the shilling has stabilised and foreign exchange reserves remain adequate, imported inflation risks have not disappeared, especially for fuel, fertiliser and manufactured goods.

The disconnect between macroeconomic stability and household hardship has political and social consequences.

Rising prices have intensified pressure on Ruto’s government, which came to power on promises of making life more affordable.

The verdict is clear: low or moderate inflation alone does not guarantee improved living standards.

What matters is where price pressures are concentrated and whether incomes are rising alongside them.

Without faster job creation, stronger wage growth and targeted measures to stabilise food and energy costs, Kenya’s cost of living is likely to remain stubbornly high, even as the numbers suggest calm.

For ordinary Kenyans, the economy is not experienced through percentages and charts, but through the daily arithmetic of what can be afforded. Until that arithmetic improves, inflation figures may continue misrepresent the true cost of living.

Read Also: Kenya’s Economic Growth 2026 Signals Cautious Recovery – Business News